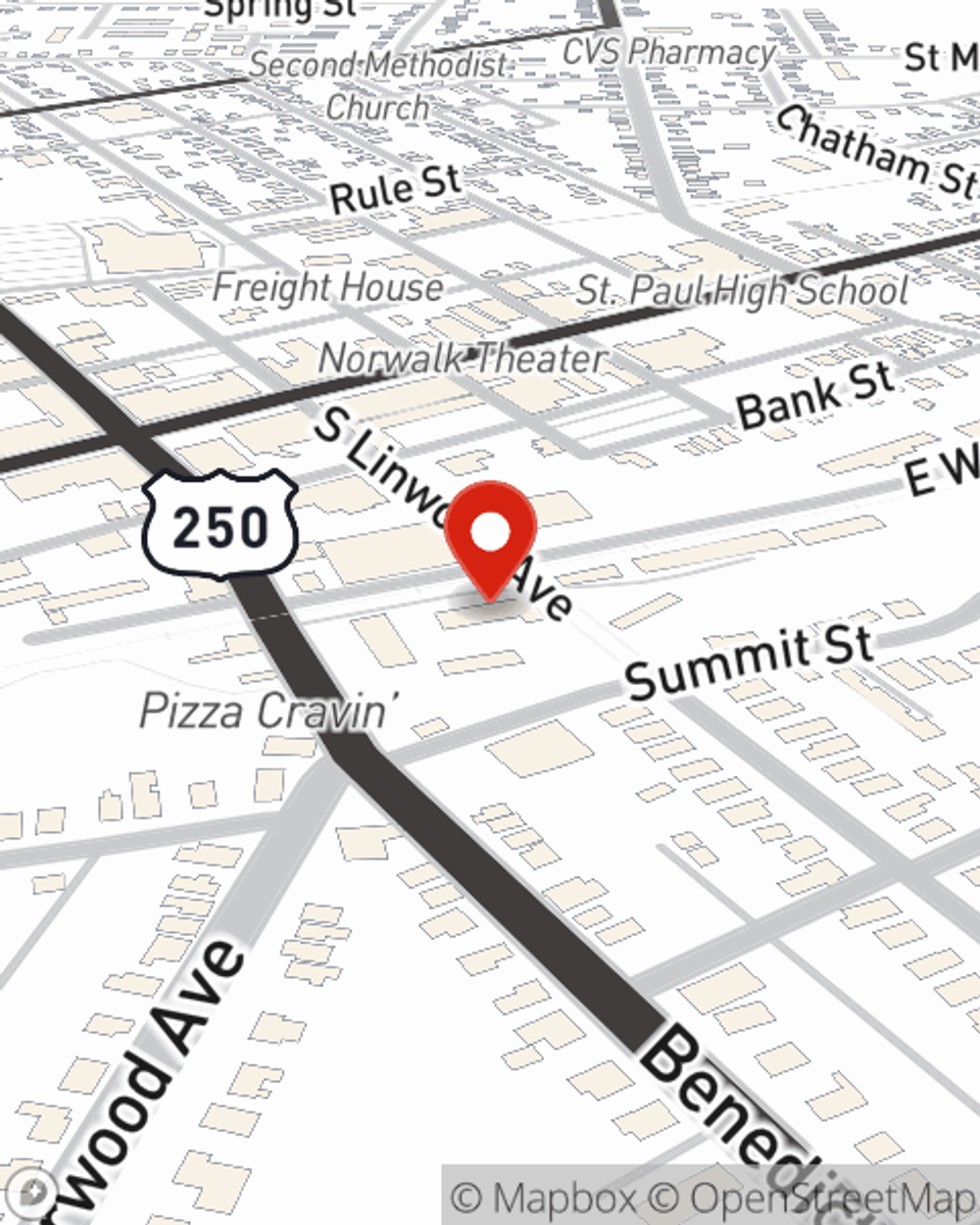

Business Insurance in and around Norwalk

Norwalk! Look no further for small business insurance.

Cover all the bases for your small business

Help Protect Your Business With State Farm.

Do you feel like there's so much to think about when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Greg Obringer help you learn about your business insurance.

Norwalk! Look no further for small business insurance.

Cover all the bases for your small business

Surprisingly Great Insurance

State Farm has been helping small businesses grow since 1935. Business owners like you have turned to State Farm for coverage from countless industries. It doesn't matter if you are a dog groomer or a taxidermist or you own an ice cream shop or an advertising agency. Whatever your business, State Farm might help cover it with personalized policies that meet each owner's specific needs. It all starts with State Farm agent Greg Obringer. Greg Obringer is the agent who understands where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to familiarize yourself about your small business insurance options

It's time to contact State Farm agent Greg Obringer. You'll quickly notice why State Farm is one of the leading providers of small business insurance.

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Greg Obringer

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.