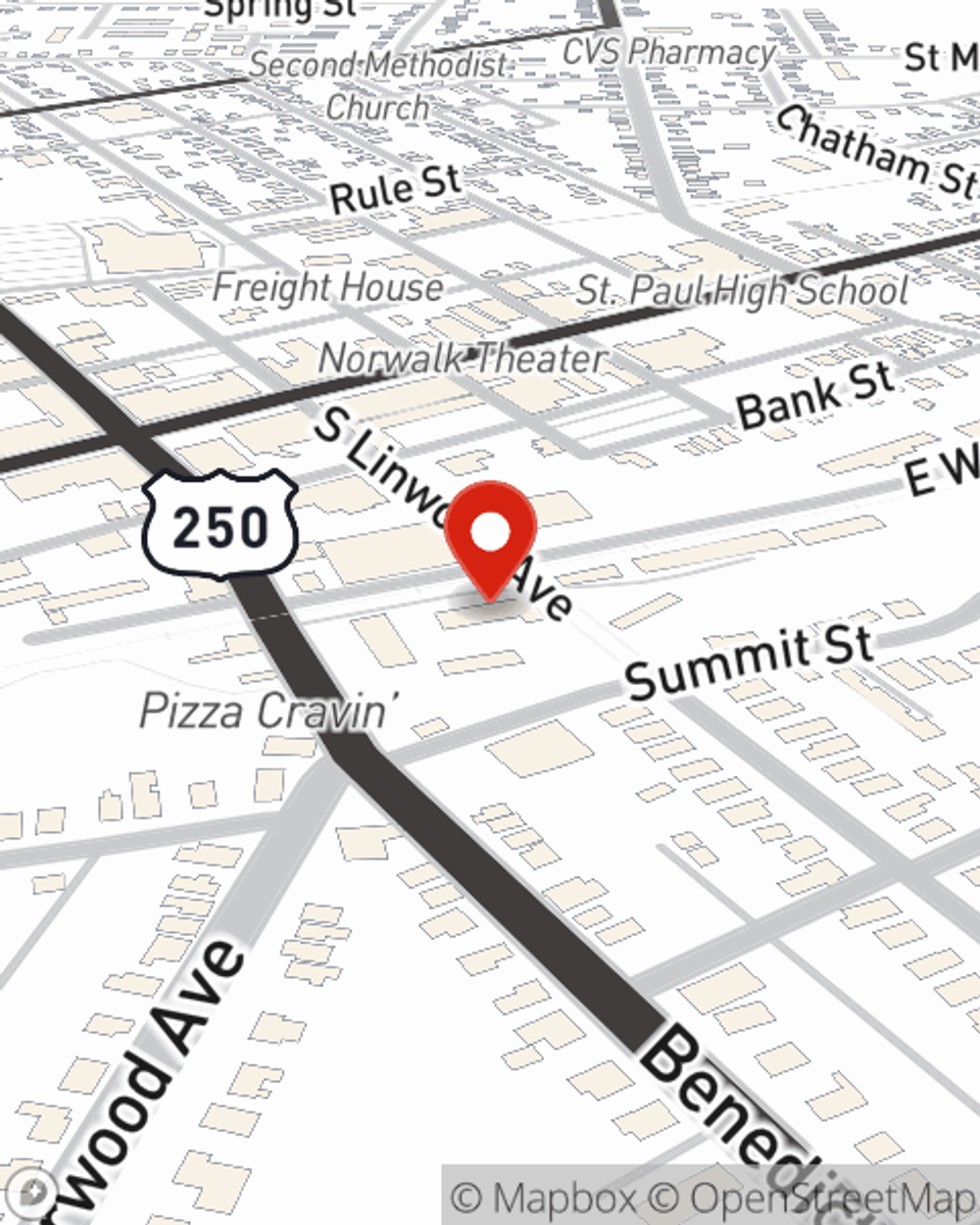

Renters Insurance in and around Norwalk

Looking for renters insurance in Norwalk?

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Home Sweet Home Starts With State Farm

Your belongings are important and so is keeping them safe. Doing what you can to keep it safe just makes sense! That’s why the most sensible step is getting renters insurance from State Farm. A State Farm renters insurance policy can protect your possessions, from your clothing to your pots and pans. Overwhelmed by the many options? That's okay! Greg Obringer wants to help you assess your needs and help secure your belongings today.

Looking for renters insurance in Norwalk?

Coverage for what's yours, in your rented home

Agent Greg Obringer, At Your Service

When renting makes the most sense for you, State Farm can help cover what you do own. State Farm agent Greg Obringer can help you identify the right coverage for when the unanticipated, like a fire or an accident, affects your personal belongings.

There's no better time than the present! Call or email Greg Obringer's office today to learn how you can protect your belongings with renters insurance.

Have More Questions About Renters Insurance?

Call Greg at (419) 660-0172 or visit our FAQ page.

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

Greg Obringer

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.